-

Welcome to consultingheads!

-

Our services

- Independent Consultants

- Freelance Experts

- Interim Manager

- Expert Teams

-

Expertise

- Strategy, Innovation & Growth

- Digital transformation & technology

- Product development & pricing

- IT Strategy, Program Management & Operations

- Sales, Marketing & Go-to-Market

- Finance, M&A & Controlling

- Supply Chain, Purchasing & Operation

- HR, Organization & Change Management

- Compliance, Legal & Risk Management

- Data, AI & Analytics

- ESG & Sustainability

- For Companies

- Ressources

The ultimate guide to private equity consulting

In recent years, private equity (PE) has established itself as one of the most dynamic and influential forms of investment on the global financial markets. This ultimate guide is aimed at beginners as well as experienced investors and entrepreneurs seeking a deeper understanding of the nature of private equity and the role of consulting in private equity.

In 2021, the procurement of private equity increased by almost 20 percent compared to the previous year and reached a record value of EUR 1.18 trillion, according to data from McKinsey's Private Markets Annual Review.

Private equity assets under management also broke a record, reaching €9.8 trillion in July - demonstrating that this form of investment is more than just an alternative source of funding. It not only offers companies the opportunity to raise capital outside of traditional financing methods such as loans, share issues and bond sales, but also opens doors to strategic partnerships, operational support and growth acceleration.

In this guide, we will explore the basics of private equity, how it works, the different strategies PE investors and firms pursue, and the critical role that PE consultants play in the success of these investments. Join us on this journey of discovery through the world of private equity and learn how this form of capital raising can transform companies and reshape the market.

Definition: What is private equity?

Private equity or also private Bequity capital refers to capital that is invested directly in private or in companies listed on the stock exchange invested is. These investments are The majority of private equity investments are made by private equity companies that specialize in the purchase, value enhancement and subsequent sale of these companies. The core idea behind private equity is to provide companies not only with capital, but also with strategic support in order to accelerate their growth and ultimately sell them at a higher value.

The importance of private equity for companies

Private equity (PE), plays a critical role in the global economy by providing companies with access to capital and resources that are essential for growth and transformation. The importance of private equity cannot be overstated, as it provides a vital source of funding for companies looking to move outside of traditional public markets or in need of additional funding beyond what banks or the public market can provide.

Private equity explained simply

Private equity (PE) is a fascinating and complex world that has far-reaching implications for the global economy and individual companies. At its core, a private equity firm raises money from institutional investors and high net worth individuals to invest in companies it believes are capable of growth or undervalued. These companies, known as portfolio companies, are at the center of the private equity strategy, with the aim of increasing their value and later selling them at a profit.

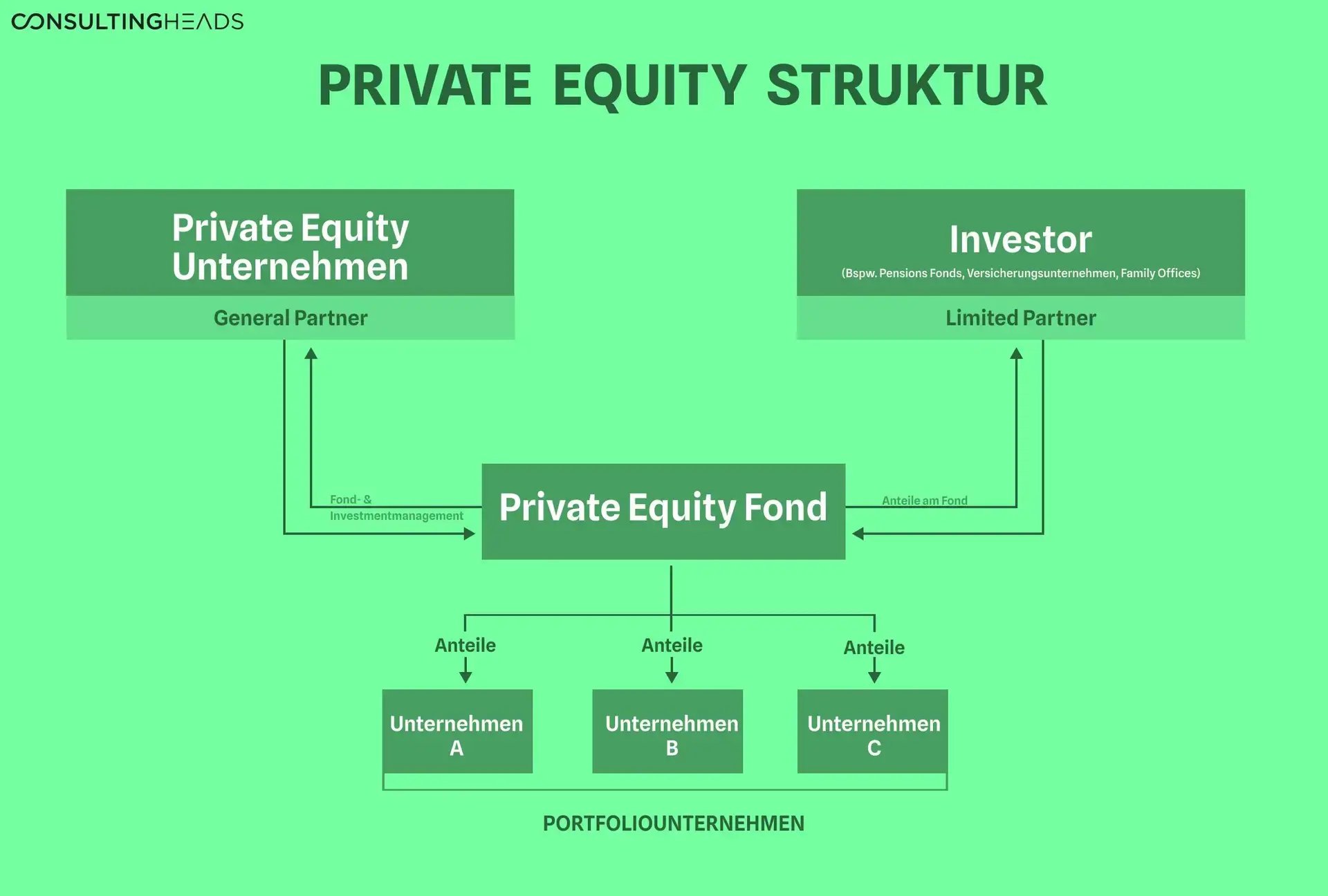

Take a look at the image below to better understand what a PE organizational structure looks like:

The role of PE companies

A PE company acts as a financial sponsor and uses the funds raised to make direct investments in selected companies. In order to be able to make significant investments, PE funds often work with considerable amounts of capital, with minimum investment amounts of EUR 250,000 up to millions being not uncommon. This financial clout enables private equity companies to invest in several companies at the same time.

Investment strategy and objective

Private equity companies carefully select their investment targets based on the life cycle and growth potential of the companies. From start-ups to established companies to struggling firms, each private equity firm has a strategy that determines what type of company it invests in. The main objective is to buy a company at an undervalued price, strengthen it with financial and intellectual capital and, after a period of improvement, sell it at a significantly higher price. This process can include, for example, delisting a listed company, realigning management and implementing measures to improve financial performance.

The value enhancement process

Private equity firms' hands-on approach to managing their portfolio companies is central to value creation. By working closely with management and implementing strategic initiatives, private equity firms aim to maximize the value of the company. This may be through a sale to another PE firm, a sale to a larger company or an IPO, with the aim always being to achieve a higher price than the original investment.

Return for investors

The ultimate goal of a private equity firm is to generate an attractive return for its investors, usually within a time frame of four to seven years. The success of a fund is critical to the PE firm's ability to raise further funds in the future. By applying a well-thought-out strategy and taking an active management role in their portfolio companies, PE firms strive to achieve significant increases in value while minimizing risk for their investors.

Private equity thus offers a unique mechanism for capital growth and corporate development that goes far beyond what traditional forms of financing can provide. It is a crucial tool for companies seeking growth and for investors looking for above-average returns.

What is a private equity company?

A private equity firm is a type of investment firm that raises money from investors to invest in companies with the aim of selling them later at a profit. These firms are often smaller than investment banks and often consist of only 5 to 20 employees who act as fund managers or general partners. These partners raise money from investors (called limited partners), invest it in companies, improve their value and then sell them, usually through a takeover or an initial public offering (IPO), to make a profit.

Private equity companies earn their money in two main ways: through the fees they charge for managing the money invested (around 1-2% of the capital invested) and through a share of the profits from the investments (around 20%).

According to a report by Bain & Company these companies sold assets worth 957 billion dollars worldwide in 2021. This shows the volume of private equity activity and explains why both top talent and investors are attracted to this sector.

One major advantage of private equity companies is that they are not publicly traded and are therefore not subject to the same disclosure requirements as listed companies. The other advantage lies in their strategies, which combine business and investment portfolio management.

Private equity strategies

There are different strategies that private equity firms use, depending on the stage of development of the companies they invest in. Here are four common ones:

- Leveraged buyouts: Here, a company buys a majority stake in an often undervalued company, financed by loans that the purchased company itself secures. The aim is to improve the company quickly and then sell it for a large profit or float it on the stock market again.

- Management buyouts: Similar to leveraged buyouts, but existing management buys the company, sometimes with the help of private equity funding.

- Growth capital: Investment in established companies that want to expand. In return for the financing, the PE receives shares in the company.

- Venture Capital: An early form of private equity where investments are made in fast-growing start-ups, usually in new sectors. In return for the risk, investors receive shares in the company.

In summary, private equity is an important source of financing for companies at all stages of development and offers investors the opportunity to invest in unlisted companies and potentially achieve high returns.

Private equity: Navigating innovation and growth with consultingheads

The world of private equity is constantly evolving and innovating. Looking to the future, we can expect private equity firms to play a central role in the transformation and growth of the global economy. The ongoing adaptation of their strategies to changing market conditions and the increasing importance of sustainable and responsible investment will be at the heart of this. For companies seeking growth and transformation, private equity offers a unique opportunity to gain not only financial support, but also strategic partnerships and expertise.

In this dynamic environment, consultingheads understands the crucial role that specialized private equity consulting can play. At consultingheads, we specialize in connecting you with the right consultants and interim experts in private equity. Our goal is to ensure that you have access to the knowledge and skills necessary to optimize your investments and realize the full potential of your private equity initiatives. Through our expert placement services, we help you achieve your strategic business objectives.

Shaping the future of private equity: expertise is key

In a rapidly evolving private equity landscape, the right expertise is critical for growth and transformation. consultingheads connects you with the right candidates to optimize investments and achieve strategic business goals.

Discover more consultingheads articles

A/B testing: How to optimize your recruiting

In an increasingly competitive job market, it is crucial that companies identify and hire the best talent quickly and...

M.E.C.E. principle consultingheads

Prcise and effective problem-solving methods are essential in the world of consulting indispensable. One such method,...

Part 1: E-mobility - trend or game changer?

Digitalization, bureaucracy, climate and social change. Will Germany get its act together in a mobile global culture or...