If you are a consultant and are thinking about starting your own business as a freelance consultant, then you are like many other consultingheads users. The desire for flexibility and self-determination with regard to projects and working hours is often at the forefront. Self-employed consultants can expect comparable compensation to their salaried colleagues, but benefit from greater freedom and a better work-life balance

But the consulting exit as a freelancer brings with it some hurdles that you should not underestimate: You are responsible for your own project acquisition and have to assert yourself against a constantly growing competition. Your workday is filled with annoying paperwork and worrying about your unsteady income. Early and thorough planning is therefore particularly important for future freelance consultants.

We help you on your way into freelance consulting. In the first part of our guide for freelance consultants, we answer the questions you should ask yourself before deciding on this career path.

In the second part, we give you concrete and helpful tips for your start as a freelance consultant: Freelance Consulting – In 10 steps to becoming a successful freelancer.

What is a freelance consultant anyway? The difference between freelancer and freelancer

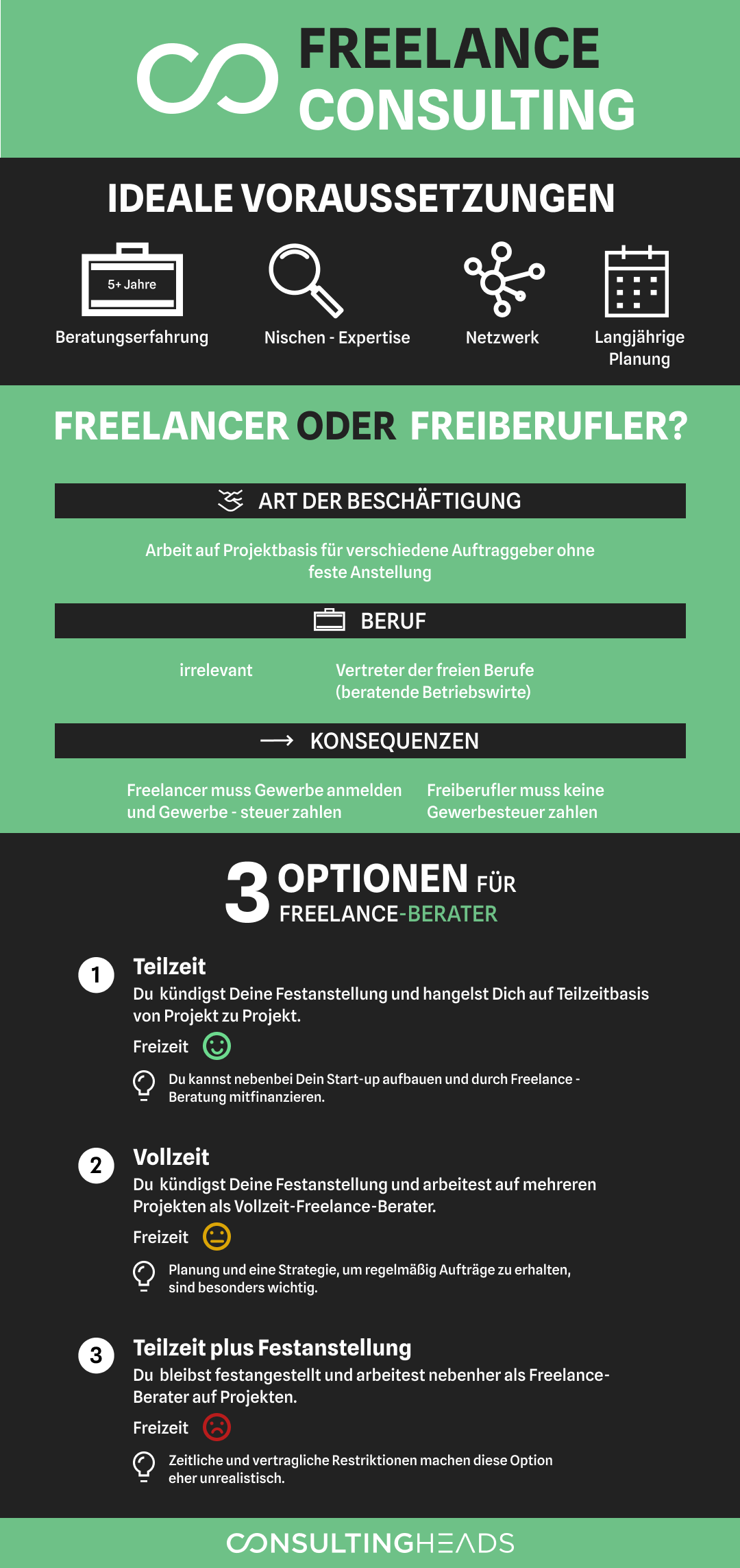

The terms “freelancer” and “freelance” are often used as synonyms. However, upon closer inspection, there are subtle differences between the two designations:

Freelancer definition

Regardless of the industry, so-called “freelancers” work as self-employed persons on a project basis for various clients. A freelancer therefore shimmies from project to project without being permanently employed by a company. The term “freelancer” thus refers exclusively to the type of employment and not to the activity pursued.

Definition freelancer

The term “freelancer” refers to the same type of employment as the freelancer. However, the exact occupation or profession pursued is also taken into account. Freelancers in fact, are representatives of the liberal professions, which are legally defined in § 18 paragraph 1 of the Income Tax Act. This paragraph states:

“Freelance activity includes the independently exercised scientific, artistic, literary, teaching or educational activity, the independent professional activity of physicians, dentists, veterinarians, lawyers, notaries, patent attorneys, surveyors, engineers, architects, commercial chemists, auditors, tax consultants, consulting economists and business economists, certified public accountants, tax agents, non-medical practitioners, dentists, physiotherapists, journalists, photojournalists, interpreters, translators, pilots and similar professions. “

Freelance consultant or freelance consultant - Which is it?

Particularly in consulting, the exact designation often leads to confusion. As cited and bolded in the previous section, “consulting economists” are among the representatives of the liberal professions.

However, according to the Federal Ministry for Economic Affairs and Energy, not every management consultant can automatically be classified as a freelancer, as the term “management consultant” is not a protected job title by law. Therefore, the tax office must first check whether certain requirements are met. For example, proof of a relevant business administration degree must be provided.

But why is that even important? In itself, the designation is incidental, but the categorization leads to bureaucratic differences in individual cases. Freelancers have to register a business and pay trade tax, while freelancers only have to report their activities to report.

Small tip: If you are an authorized consultingheads user, you can in principle assume to be eligible as a freelance consultant. Finally, we screen our users by consulting background and academic profile.

The Freelance Trend in Consulting

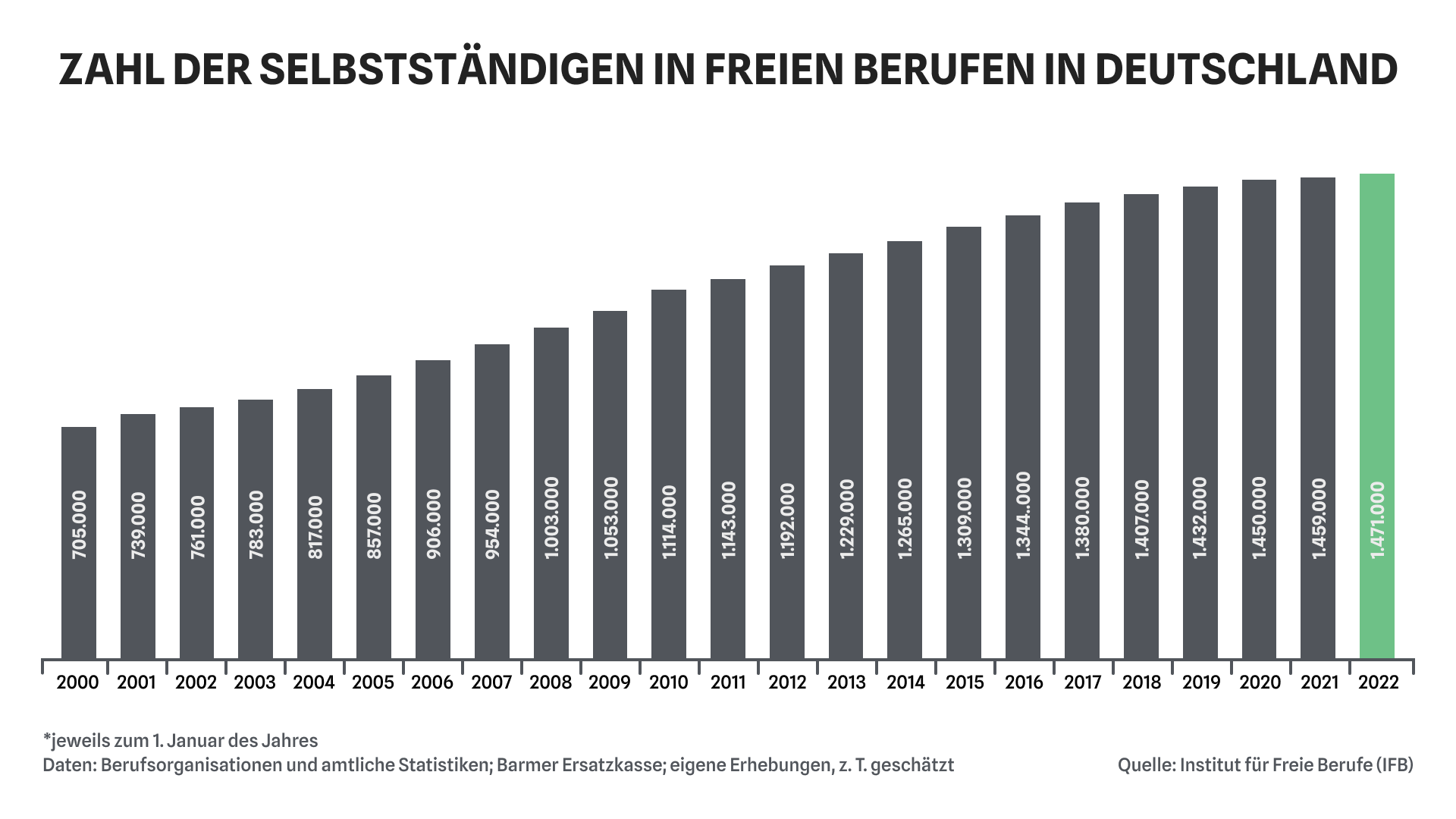

With the aging of the freedom-seeking Generation Y and Z, the freelance trend has surged across all industries in recent years. This is because the desire for self-determination also affects the choice of career. According to the German Association of Liberal Professions, for example, the number of self-employed in the liberal German Association of has risen steadily in recent years.

This development is also causing noticeable changes in the consulting industry. Moving from permanent employment to self-employment is a popular “move” for consultants.

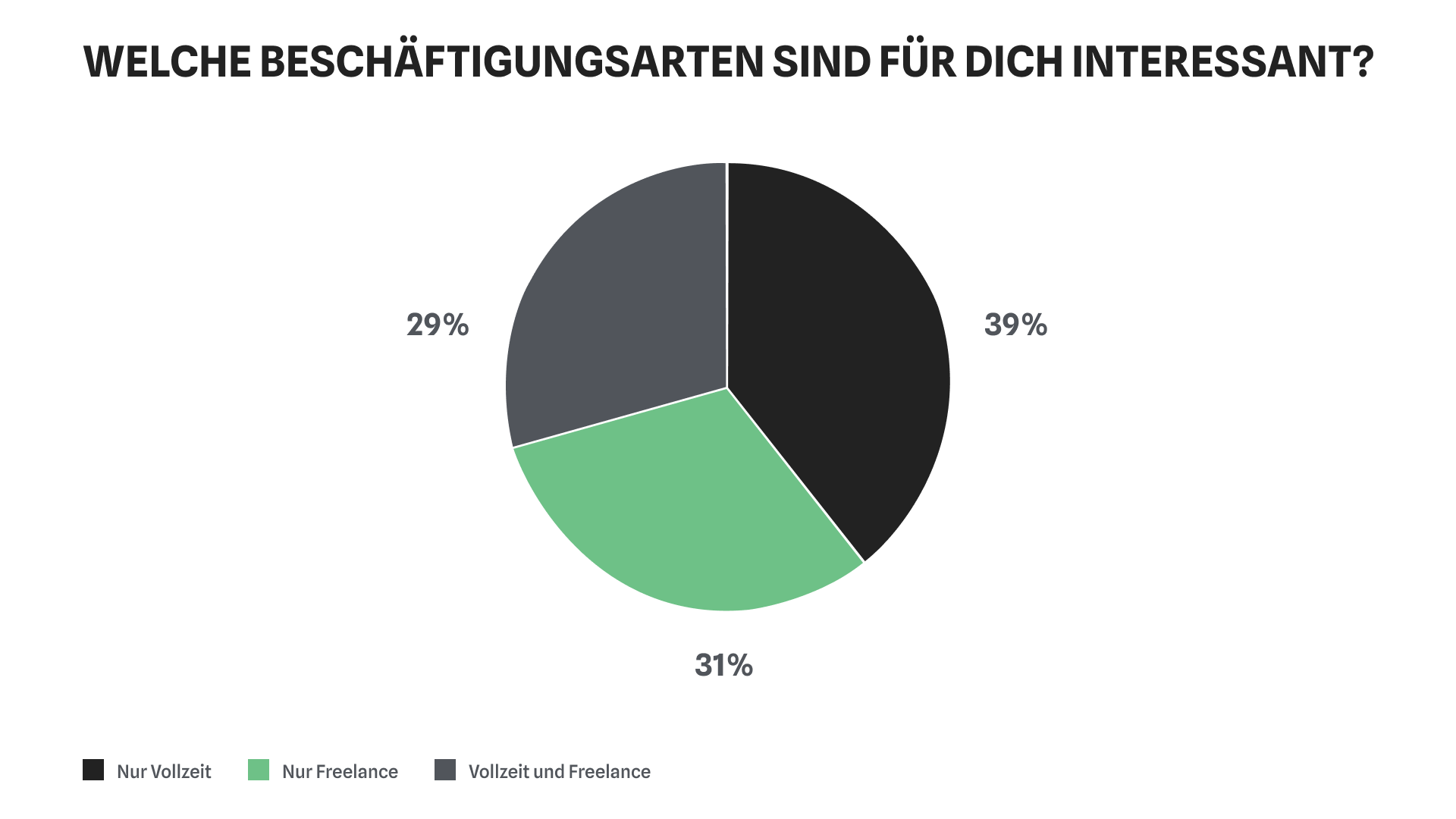

The Institute for Research on Small and Medium-Sized Businesses estimates the number of consultants currently working on a freelance basis in Germany at over 50,000. The information provided by our users confirms the interest in freelancing among consultants: 60% of consultingheads users are interested in a freelance position, 31% are exclusively interested in it

Nevertheless, the freelance consultant is not a brand new phenomenon. Even in the past, companies wanted impartial advice, independent of large companies and their sales targets. Even then, many consultants were happy to fulfill this need.

But one thing has clearly changed: Whereas twenty years ago only the “old hands” with strong networks could get by as freelancers, today, thanks to digitization, project and customer acquisition is easier than ever before. Online platforms such as consultingheads bring companies and freelance consultants together efficiently and conveniently. Companies and consultancies also benefit. You can cover short-term peaks in demand with freelancers and thus work even more cost-efficiently

When is the ideal time to leave consulting as a freelancer?

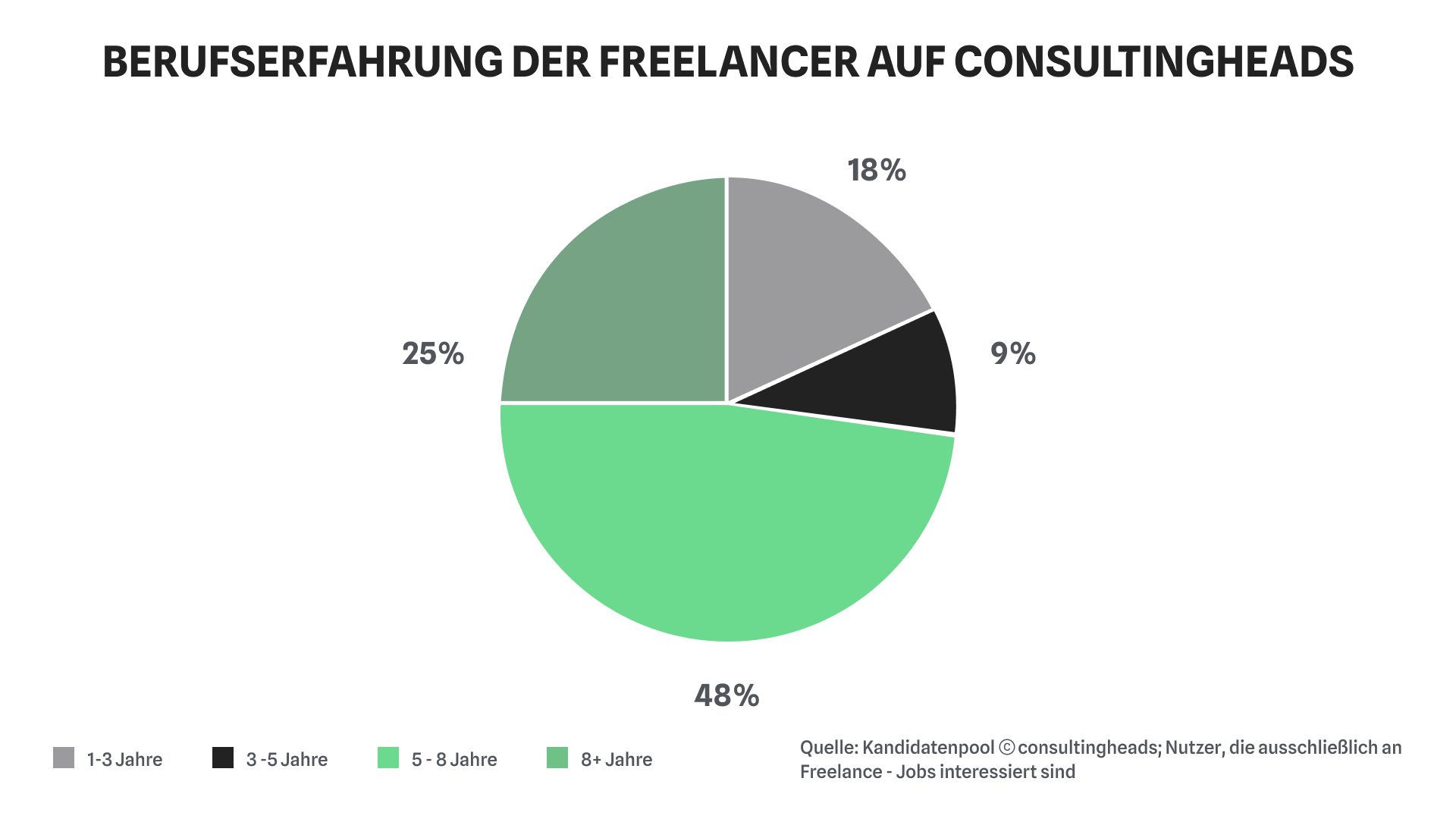

It is difficult to establish a general rule, because the ideal time to exit as a freelancer depends on you, your expertise and your network. A full 73% of our freelance consultants on consultingheads have at least five years of professional experience in consulting:

However, through our experience and cooperation with companies, we know that especially young “hungry” consultants with two to three years of experience are increasingly sought after. Therefore, we make the recommendation that you should exit after about three years of consulting experience if you want to work as a freelance consultant.

At consultingheads, we have also placed candidates for freelance positions who had only one or two years of consulting experience. However, this only works in exceptional cases and under the following conditions:

- You already have a strong expertise in a niche that is particularly in demand among companies.

- Despite your short experience you already have a solid network of clients through professional and/or personal contacts as well as mediation platforms.

- You bring a fair amount of self-confidence to hold your own against senior managers despite your probably younger age.

No matter at what point you decide to exit as a freelance consultant, you should consider your decision thoroughly and plan your exit plan. Learn more tips in the second part of our freelance series!

The way to freelance consulting

Many paths lead to freelance consulting. Ideally, they have the following in common: they start with a permanent position at a management consultancy – whether MBB, Tier 2 or boutique consultancy – or include this career stop at some point in the resume.

Of course, not all freelance consultants start out in consulting and then move directly into freelancing. Many of our users also go through other career stages and initially switch to industry or a start-up, for example. Regardless, you have several options to get started as a freelancer:

Option 1: You work as a part-time freelancer after the consulting exit

On the way to freelancing, most consultants decide to work as part-time freelance consultants for the time being. This is also the option with the highest probability of success, because you will often not have enough orders to work full time, for example. Maybe you don’t want to, because you have other priorities:

- You want more free time and to benefit from a better work-life balance. For example, you want to start a family or take more time for your family and friends.

- You plan to start a startup on the side. This way you combine two forms of consulting exits: freelance consulting and start-up founding. In addition, you can finance your start-up with two to three days of project work per week in the initial founding phase.

Option 2: You become a full-time freelance consultant directly after the consulting exit.

Alternatively, you can quit your permanent position and work directly as a full-time freelance consultant. This is probably the dream of most aspiring freelancers, but it’s easier said than done!

You won’t fill up your calendar without a broad portfolio of clients and projects in your pocket. Therefore, you must have already prepared for it for many years and built a strong reputation. Thorough planning is important in any case, but especially if you are a freelance consultant on a full-time basis, you need to develop a secure strategy for regular client acquisition.

Option 3: You remain employed as a consultant and become a freelance consultant on the side.

With this option, you’ll be on two tracks for the time being. That is, you keep your permanent position in consulting and use evenings or weekends for project acquisition and work on projects. This gives you the chance to see if freelancing is for you. Although this option is less risky, since you can continue to work with your fixed salary and job, but it is clearly more stressful and difficult to implement. You should expect the following problems:

- Pure stress without compensatory time off: Let’s face it, isn’t working as a full-time consultant demanding enough? If you then also sacrifice what little free time you have for freelance projects, you really have to be stress-resistant!

- Contractual restrictions: You will probably have to clarify your secondary employment with your current employer. Depending on the project, you may also be restricted by a non-compete agreement in which you agree not to work for a competitor.

- Time difficulties: Apart from giving up all your free time, depending on the flexibility of the project, it will not be possible at all to pursue your full-time job and be present on your freelance project at the same time, as the working hours will overlap.

You have no consulting experience, but would like to become a freelance consultant

In rare cases, you can become a freelance consultant without consulting experience. Similar requirements apply here as for the exit after a few years of consulting experience. With a special and highly demanded expertise, which you could acquire in your profession, you can prevail against freelancers with consulting experience if necessary. You also need a good network, self-confidence and realistic project and salary expectations.

But it will definitely be difficult to convince companies to hire you for a project if you don’t have any consulting experience. An alternative is to first apply to a consultancy for an entry-level position as an experienced hire without a consulting background, and then exit as a freelancer. If you still decide to work as a freelance consultant, remember: Without consulting experience, you are not considered a freelance consultant, but must register a business for your freelance activities.

In the second part of our freelance series you will find even more tips and advice on your first steps as a freelance consultant: In 10 steps to becoming a successful freelancer.

Sources:

-

Federal Ministry of Justice and Consumer Protection: “Einkommenssteuergesetz (EStG) § 18” Accessed at: https: //www.gesetze-im-internet.de/estg/__18.html

-

Eidmüller, C.; Bundesministerium für Wirtschaft und Energie – Existenzgründungsportal: “Management consulting: freelance or commercial activity?” Accessed at: https://www.existenzgruender.de/SharedDocs/BMWi-Expertenforum/Gruendungsplanung/Freie-Berufe/beratende-Taetig/Unternehmensberatung-freiberufliche-oder-gewerbliche-Taetigkeit.html

-

Institute of Liberal Professions Nuremberg: “Development* of the Self-Employed in Liberal Professions in Germany 2000 – 2022 (in thousands)”. Accessed at: https://www.freie-berufe.de/wordpress/wp-content/uploads/2022/08/BFB_Fakten-Grafiken_2022-08_Entwicklung_2000.pdf

-

Institut für Mittelstandsforschung: “Selbstständige in den Freien Berufen nach Berufsgruppen” Accessed at: https://www.ifm-bonn.org/fileadmin/data/redaktion/statistik/selbststaendige-freie_berufe/dokumente/FB-Selb_BG_2001_2017-2021_D.pdf

Become part of our community for the most exciting freelance projects

You and your next challenge – in the consultingheads community, what belongs together comes together. We will find you your next project in a top company. Perfectly tailored to your profile.